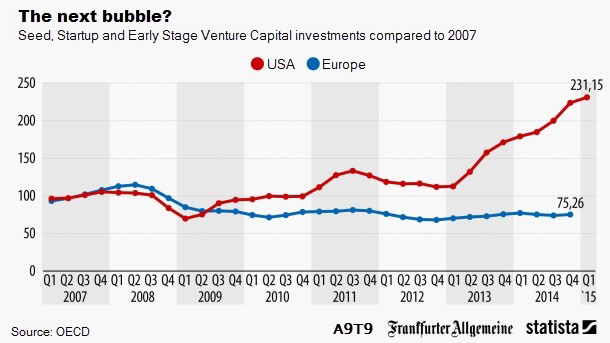

New evidence for the next startup bubble?

Silicon valley and the USA in general are well-known for their entrepreneurial spirit. But are they overdoing it currently? Investments in startups in the United States is experiencing a real boom since 2013. The graphic below is based on OECD data.

Source: FAZ and Statista, license CC-BY-ND 3.0

If we assume the raw data is correct: According to this chart more than twice as much money was invested in seed, startup and early stage venture capital in 2014 than in 2007. The American market recovered after the financial crisis, soaring to new heights from early 2013 on. However, the situation in Europe is quite different. Here the investments continue to remain at a level below that of of 2007. So is this evidence for the startup bubble? Or is it simply evidence for an “old Europe”? I have no idea, but the data is interesting and thought-provoking.